The pomegranate’s reputation as a superfruit has made it more desirable since it has become available in more countries. Also, people have shown great interest in growing pomegranate recently. In addition, there is intense competition in the pomegranate market. As a result, many difficulties exist in pomegranate marketing. This article may help you to recognize them and deal with them easier.

In Europe, Chile has been losing market share to Peru. Due to the end of the Peruvian season, prices in Europe have again increased. There is a wide variety of pomegranate quality in Spain, where pomegranates are currently available on the market. Israel and Egypt ship their products to Europe as well. It is Chile that supplies most of the US pomegranate. Chinese consumers are mostly self-sufficient.

International pomegranate marketing

The target society of the pomegranate market includes all developing and developed countries, multiple shops, and small retailers. Digital marketing is the main focus of many production companies around the globe.

A lot of traders consider digital marketing since online sales have a 15% increase every year. Alternatively, pomegranates are fruits that mature at the end of the summer or fall. Prices are different during the harvest season from when the crop was in the refrigerator or on an online sale.

It is estimated that Iran produces 670,000 tons of pomegranates annually, making it the world’s top producer and exporter. Other countries which cultivate pomegranates include Japan, Italy, India, Spain, France, China, Turkey, Egypt, Armenia, Greece, Tunisia, Cyprus, Palestine, and Afghanistan.

Wild pomegranate can be found in India, Afghanistan, and Syria, but it is native to Iran. The majority of good-quality pomegranates are produced in Turkey, Iran, Afghanistan, Syria, Morocco, and Spain at present.

Also, pomegranates are harvested in India over nine months. Currently, Iran, India, and Turkey produce the most pomegranates in the world. Pomegranates are exported to universal markets at a value of more than 3 million dollars.

Countries and their export capacity for pomegranates

If you want to succeed in pomegranate marketing, you have to recognize what countries export pomegranate. Originally native to Iran and northern India, the pomegranate has become widely cultivated throughout the world, as we mentioned before.

Iran exports pomegranates to countries that have a high potential for exporting pomegranates like Iraq, China, and Russia. There is a close relationship between Iran and Armenia in terms of pomegranate exports. Chinese consumers have the most demand capacity for pomegranates.

The fact that some goods are only available in some countries is noticeable. Iran has the ability to export in 40-50 countries with a transmission distance of up to 4000 kilometers.

What do buyers often require?

Certification as guarantee

All of Europe’s food sectors place a high emphasis on food safety, so buyers will ask you for additional assurances in terms of certification. Pomegranates normally undergo GLOBALG.A.P. certification, which covers their entire production cycle — from before the plant is in the ground to after they are harvested.

GLOBALG.A.P. is an increasingly important requirement for most supermarkets, particularly in northern Europe, making its availability practically impossible without it.

Food safety management systems require also:

- SQF (Safe Quality Food program)

- IFS (International Food Standard)

- FSSC22000 ( Food Safety System Certification)

GLOBALG.A.P. is supplemented by these management systems. And GFSI (Global Food Safety Initiative) has recognized them.

Social and environmental compliance

In the areas of production, environmental and social conditions are becoming increasingly important. It is expected that you will adhere to a social code of conduct by most European buyers. The number one priority for pomegranates is product quality, but compliance with social standards is also important.

Certification in GRASP can be an advantage. GRASP, an accessible certification that has gained popularity in Europe, is part of the Global Gap and a social add-on.

Alternatively, you can implement the Sustainability Initiative Fruit and Vegetables (SIFAV). Fair-trade certification schemes tend to be complex and expensive, which has made them unattractive to market players in the fresh trade.

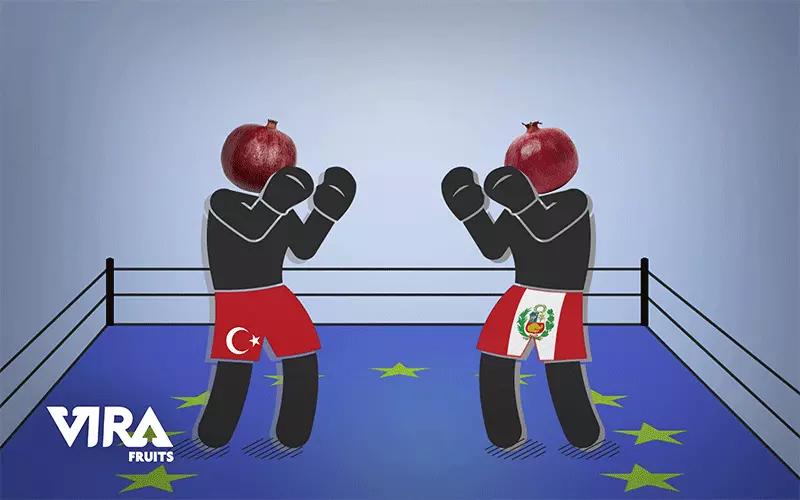

Competitions and challenges on the European pomegranate market

Here are some of the competitors you will be facing on European pomegranate marketing:

- Product competition

- Strong competitors like Peru and Turkey are emerging.

- Powerful retailers are reliant on concentrated channels

- Expanding the availability of pomegranate

- The fact that producers can improve technology and cultivars